Volatile Markets: Don’t rely on headlines for guidance on when to invest

Falling markets and drastic headlines can tempt individuals to abandon their long-term investing plans. Their thinking might go something like, let’s wait until it’s over, hoping to catch the market at its lowest point before buying in. Or in rising markets, maybe they seek to ...

No, JP Morgan CEO is not acting in your best interest.

Written By: Daniel Carnes Jaime Dimon is a name you will only hear over the major news outlets. And for good reason. He is currently the CEO of the largest bank in the world, JP Morgan. Since he’s in a prominent position in the world, ...

Bitcoin Basics Seminar Replay

What is Bitcoin? What is the blockchain? How can it be used? What risks does it pose? What should you know about investing in Bitcoin? Many of you have been asking to learn more about Bitcoin, so we put on a seminar ...

What to do when a medical emergency disrupts your life

What are the most important things you really want when it comes to money? To feel secure. Have peace about your financial future. Generate a steady retirement income. Don’t pay more taxes than you have to. Retire with a plan and smart strategy. And what ...

Fiduciary: Funny Word, but Vitally Important Criteria

Thankfully, many professionals including doctors and lawyers are held to certain standards within their industries that require them to put the interest of their clients first. Professionals that are legally obligated to put their client’s interest first are known as Fiduciaries. However, this standard is ...

Smart Ways to Invest Your Tax Refund

Do you have a rainy-day fund? Is if fully funded? You understand the importance of reserves. Whether it’s a home repair, auto repair, a layoff or unexpected bill, having cash set aside will ease the financial burden. We recommend three to six months of readily ...

Top Longevity Resolutions

Our job is to manage your money so that it will last you for your lifetime. But how can you maximize your longevity? Take this quiz to get an estimate on your lifespan based on your lifestyle. Prioritize Sleep: Don’t underestimate the importance and positive ...

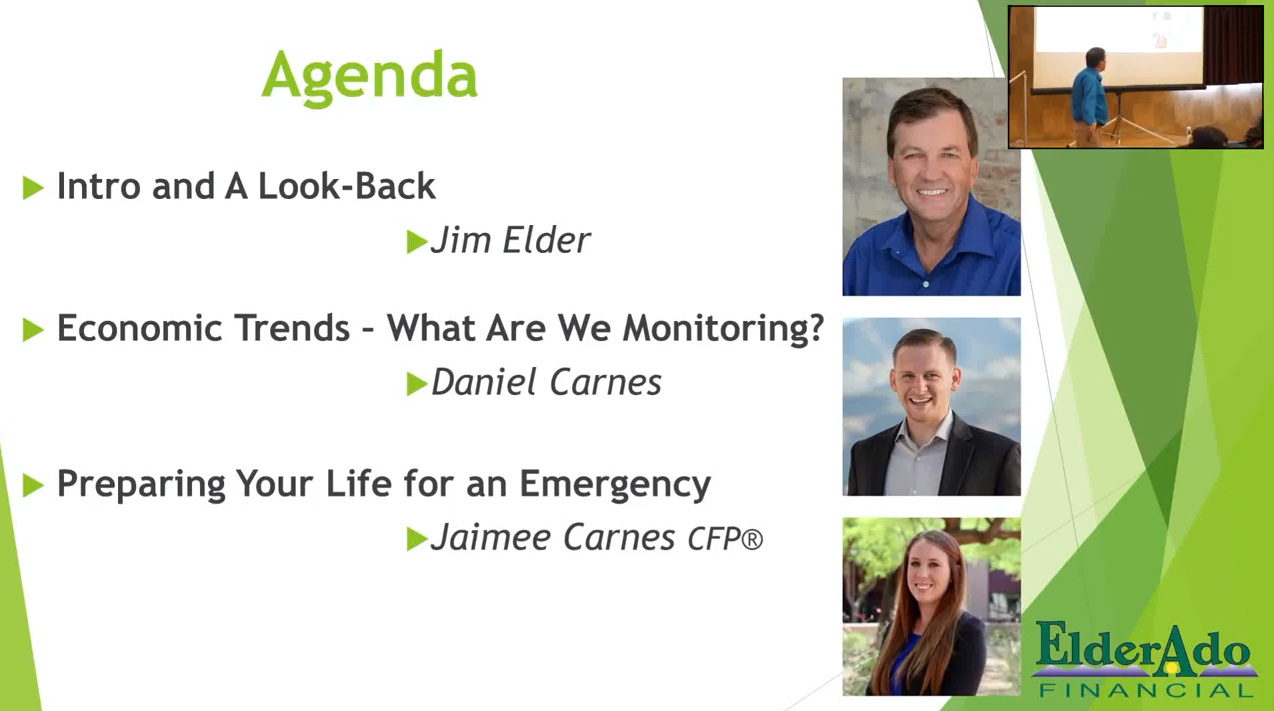

Financial Focus Seminar: Economic and Market Update October 2021

Tune in to our most recent seminar to hear our financial advisory team discuss many topics: Firm updates A Recap of 2020 The Benefits of Using a Financial Advisor: aka Advisor’s Alpha The TD Ameritrade/Charles Schwab merger What’s happening in the Economy? ...

What is it about September?

September has historically been the worst month for stocks, according to St. Louis Federal Reserve data measuring monthly S&P 500 performance over the last 50 years. If you are wondering whether the trend has abated in recent years, the answer is no, it hasn’t. Over ...

Gift Budget Planner

To help you through often expensive special occasions without getting into debt, use this fillable Gift Budget Planner to plan out your expenses.

Important Document Checklist

What you should Keep, Store or Shred There are many documents that can accumulate in a lifetime. This checklist is intended to help make it easy for you to keep organized and to know how long you should keep documents. As financial advisor we ...

10 Ways to Save After Retirement

Want to hang on to your gold in your golden years? Then keep saving even when you’ve stopped earning. Here’s how. Take the same approach to money management you did before you kissed the 9-to-5 grind goodbye. Careful planning, money management and saving will go ...

Client Appreciation BBQ 2021

Thank you to all who attended our annual client appreciation barbeque at ElderAdo Acres! Here are some fun pictures from the day. ...

Social Insecurity

Americans are living longer each year. Every 6 years, the average life expectancy increases by 1 year. For example, the US life expectancy at birth was 60.8 years in 1921 but has increased to 77.8 years in 2021. Since Americans are living longer, saving for ...

How to Manage an Inheritance or Windfall

Have you ever dreamed of winning the lottery or inheriting a large sum of money? Most have. But, riches that easily fall into your hands can quickly slip through your fingers. A study found that 1/3 of the people who received an inheritance had negative savings within two years. For ...

Inflation: The Silent Killer

Western Slope consumers have experienced a surge in prices of 4.2% over the last year! This is the highest increase since 2008! When the prices of goods increase, the purchasing value of your money decreases. A dollar that you had last year, is only worth ...

Should You Downsize Your Home?

Did you buy your home many years ago? Or have you been in your current place for a few years? There are plenty of reasons to sell and seek out a house that is smaller and one that fits your lifestyle. On the flip side, ...