The Elder Family by Montrose Living

Thank you, Montrose Living for publishing this article on The Elder Family!

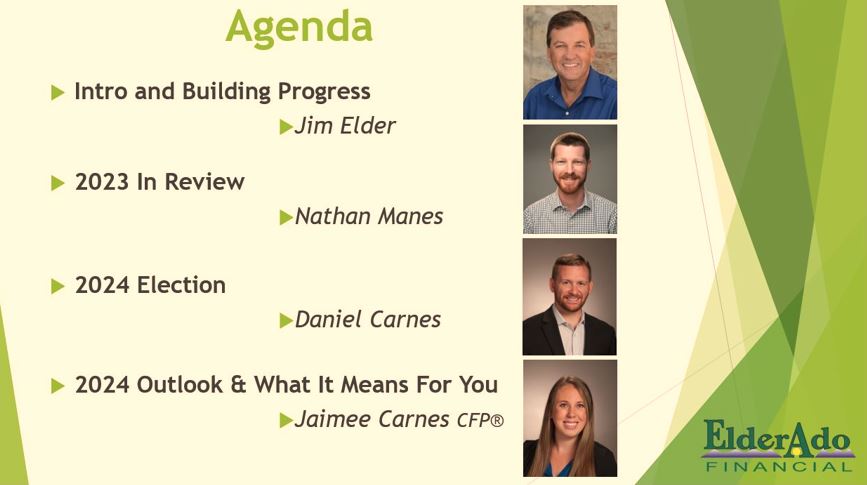

January 2024 Economic and Market Update

Tune in to hear founder, Jim Elder, share updates about ElderAdo's new building and a few items about Charles Schwab. Nathan Manes, one of our financial advisors, shared about what happened in 2023 including major events, interest rates, market recap, Bitcoin, managing ...

2024 Tax Numbers

With 2024 upon us it’s important to be armed with the most up-to-date information. Here is a handy sheet with all kinds of key financial numbers that can help you determine what your tax bracket is, contribution limits, and even Medicare deductibles. ...

Is Home Improvement Worth It?

The National Council on Aging recently shared a story about a scammer who targeted a homeowner in Massachusetts. The victim alleged that a contractor damaged his home’s foundation and didn’t return to finish the work—even after taking thousands of dollars in payments. Since 2007, 109,000 home ...

October 2023 Market Update

Tune in to our fall seminar to hear about ElderAdo's building plans, 2023 So Far, and Plans for the Future. We will also be diving into hot topics such as artificial intelligence, government spending, inflation, interest rates, digital currency, Charles Schwab merger, bank failures, volatility, ...

Celebrating 25 Years

We have been in business as fiduciary advisors for 25 Years! In 1998, Jim and Janet Elder founded a registered investment advisor firm that is now known as ElderAdo Financial. The original firm was located in Arvada, Colorado and this is where the business ...

2023 Mid-Year Market Update

by Daniel Carnes We all know that 2022 was a difficult year. The 10-year U.S. Treasury Bond had its worst performance since 1788, and the stock market was in a downturn. Most of the pain was caused by the Federal Reserve’s interest rate hikes to ...

A Tale of Two Investors

It was the best of times; it was the worst of times. But this story isn’t about two cities. It is about two investors. Two brothers actually, we will call them Billy and Randy for this story. Ten years ago, their mother passed away. After ...

Focus on What’s Important

met a couple a few years ago who were in their early 70s. For this story I will call them Jason and Carrie. As in many couples, one managed the finances, in this case, it was Jason who handled the finances during their marriage of ...

Annual Summer BBQ – 2022

ElderAdo Financial hosts an annual summer BBQ for clients, family, and friends to come out and enjoy an evening of fun, music, food, drinks, yard games, face painting, and more. This quick video highlights all of the fun we had at the 2022 BBQ. Thank ...

Making the Most of Your Social Security

On January 31, 1940, the first monthly Social Security check was issued to Ida May Fuller of Ludlow, Vermont. She received $22.54. Before passing away in 1975, she collected $22,888.92 in Social Security benefits. Interesting trivia aside, many younger folks have little faith that Social ...

How the Updated Retirement Laws May Affect You

The Setting Every Community Up for Retirement Enhancement Act of 2019, popularly known as the SECURE Act, was signed into law in late 2019. Now called SECURE Act 1.0, it included provisions that raised the requirement for mandatory distributions from retirement accounts and increased access ...

2022 Year in Review

2022 was a difficult year for many. We saw war in Europe, spiking energy prices, high inflation, a volatile stock market, a tense mid-term election, and interest rate hikes to name a few. The favorable economic circumstances we had in the 2010s (low-interest rates, low ...

Long Term Care and Your Options

Long-term care includes a whole host of services that you may require to meet various personal needs. And eventually, around 60% of us will need assistance with things many take for granted, according to the Administration for Community Living, a division of the U.S. Dept. of Health and ...

How to Protect Yourself Online

Cybersecurity is “the practice of protecting critical systems and sensitive information from digital attacks.” You may not be in the business of defending critical infrastructure from online threats. But fraud, identity theft, and online scams that target your finances pose significant challenges for everyone in today’s digital world. Armed with ...

Fall 2022 Economic and Market Update

What's the status of the TD Ameritrade/Charles Schwab merger? What do the new IRS Agents mean for you? What's happening in the global economy and how does that impact your investments? What's going on with digital currencies? Where are we now? What are we doing/monitoring in terms of your investments? ...

Should You Consider a Financial Caregiver?

Age and poor health can quickly impair a person’s ability to deal with life’s many issues, including money. There are many avenues you may decide to take for a loved one (or you may recognize that you desire some assistance yourself). Below we cover a ...